Gifts That Cost You Nothing Now

You can help conquer cancer for generations to come by creating a gift that costs you nothing now.

Gifts in a Will and Gifts by Beneficiary Designation are two easy ways to give every patient more than hope.

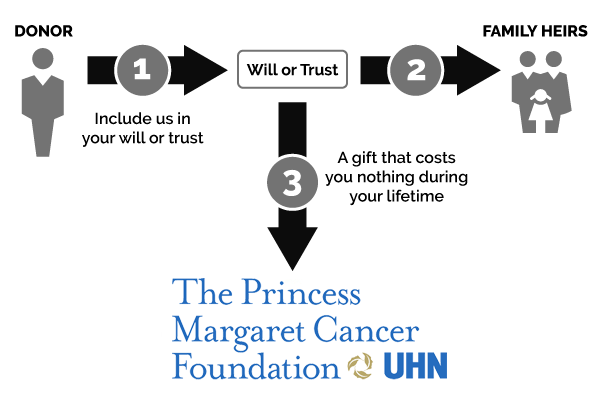

Gifts in a Will

A gift in your Will is one of the easiest ways to create your legacy of making an impact in the fight against cancer.

NO COST

Costs you nothing now to give in this way.

FLEXIBLE

You can alter your gift or change your mind at any time and for any reason.

LASTING IMPACT

Your gift will create your legacy of conquering cancer.

3 simple, “no-cost-now” ways to give in your Will

Residual gift

Leaves all or a percentage of what is left over after all other debts, taxes, and other expenses have been paid.

Specific gift

Leaves a specific dollar amount, or specific items (collections, art, books, jewellery, and so on).

Contingent gift

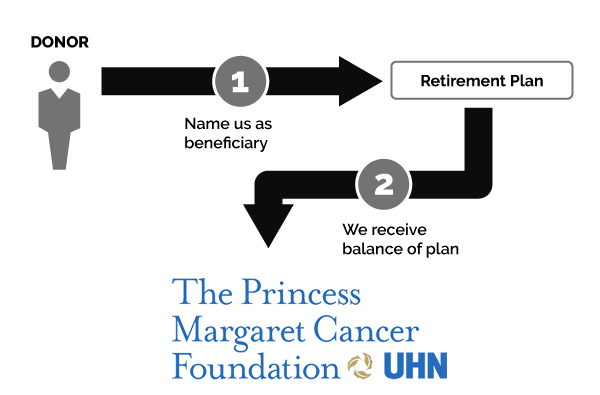

Gifts by Beneficiary Designation

It’s easy to put your retirement savings plan (RRSP), registered retirement income funds (RRIF), Tax-Free Savings Accounts (TFSA), mutual funds, life insurance, or other financial accounts to use in building your own legacy to help conquer cancer through The Princess Margaret — and it costs nothing now.

By naming The Princess Margaret Cancer Foundation as a beneficiary of these assets, you power our approach to fighting cancer that will make a lasting impact and help generations of patients to come.

Potential benefits of gifts by beneficiary designation:

Create your legacy with The Princess Margaret Cancer Foundation

To name The Princess Margaret Cancer Foundation as a beneficiary, contact your bank, retirement administrator or insurance company to see whether a change of beneficiary form must be completed.

How to Change a Beneficiary Designation

Login to your account or request a Change of Beneficiary Form from your custodian (the business holding your money or assets).

Follow the links to change your beneficiary or fill out the form.

Be sure to spell the name of our organization properly: The Princess Margaret Cancer Foundation

Include our charitable registration number: 88900 7597 RR0001

Save or submit your information online or return your Change of Beneficiary Form.

Types of Gifts

A Gift of Retirement Funds (RRSP or RRIF)

You can simply name The Princess Margaret Cancer Foundation as a beneficiary of your retirement savings plan (RRSP) or registered retirement income funds (RRIF) to help patients for years to come.

You may be able to reduce taxes on your income and your estate, possibly leaving more for your loved ones.

A gift of funds remaining in your bank accounts, brokerage accounts or certificate of deposit (CD)

This is one of the easiest gifts to give and one of the most useful in accomplishing what you want – to fight cancer. The next time you visit your bank, you can name The Princess Margaret Cancer Foundation as the beneficiary of a checking or savings bank account, a certificate of deposit (CD), or a brokerage account. When you do, you’ll take a powerful step toward conquering cancer for future generations.

Donor-Advised Fund (DAF) residuals

Savings Bonds

Complimentary Planning Resources are Just a Click Away!

Easy Ways to Make a Lasting Impact

We're here to help

Genane Peniak

Associate Director, Estates and Gift Planning

The Princess Margaret Cancer Foundation

legacy@thepmcf.ca

416-660-1276

Hannah Tsui

Development Officer, Estates and Gift Planning

The Princess Margaret Cancer Foundation

legacy@thepmcf.ca

647-534-7844